The Global Food Fight: Is the Size of the Prize Worth the Fight? (Part 1/3)

Over the last 10 years, arguably the biggest development in the global restaurant industry has been the growth of food delivery companies such as Uber Eats, Doordash, Delivery Hero, and Just Eat Takeaway.

Source: Company Filings

“GMV”: Gross merchandise volume (millions)

“CAGR”: Compounded annual growth rate

The growth has been impressive, but it was achieved while producing over $5 billion in cumulative operating losses.

The significant operating losses spark two important questions:

Will leading food delivery businesses be valuable free cash flow generative companies? If so, how valuable could the industry leaders become?

Over the last two decades, the food delivery industry has had several phases that we describe as food delivery 1.0, 2.0 and 3.0. To answer the important two questions above, we must dig deeper into the three phases of industry development starting with food delivery 1.0.

Food Delivery 1.0: Food delivery has been around for decades.

It is often perceived that the food delivery industry is new because of the significant growth of DoorDash and Uber Eats, but in fact, many restaurants have been offering delivery for over 50 years.

Before restaurant delivery websites were invented in the late 90’s and early 2000’s, when you wanted to order in, it was pizza, Chinese, or another local independent restaurant. There weren’t that many options. Delivery restaurants would market their phone number in the yellow pages and their employee’s would deliver the food. When they delivered your meal, they would leave you with a paper menu in hopes that you became a recurring customer. The telephone is what enabled food delivery restaurants to exist.

Below are some of the most common food types that have been delivered for decades.

Source: YouGov

Converting phone orders to internet orders.

When the internet became increasingly popular in the late 90’s and early 2000’s, several companies developed websites where delivery restaurants could post their menus and receive orders online. Delivery restaurant marketplaces were two-sided networks, connecting consumers and delivery restaurants. This is how Just Eat Takeaway, Grubhub, and Delivery Hero’s business started and is what we will call “food delivery 1.0 marketplaces”.

Source: https://www.uncorkd.biz/blog/restaurant-apps/grubhub-food-delivery-app/

The centralized one-stop shop for delivery restaurants dramatically improved the shopping experience. When more consumers ordered from a food delivery marketplace, more economic opportunity was created for delivery restaurants. More economic opportunity for restaurants then fueled more restaurants to join the marketplace which drove more consumers to use the marketplace and hence, a flywheel was formed.

The flywheel, that is often described as network effects, drove concentrated food delivery market structures where typically one player controlled more than half of the market in a given country. Whoever had the widest supply of delivery restaurants and the highest brand awareness won.

The growth of food delivery 1.0 marketplaces was driven by simply converting phone orders to digital orders and by increasing consumer awareness of the local restaurant options that already offered delivery.

The order economics for food delivery 1.0 marketplaces are attractive.

Food delivery 1.0 marketplace’s charge a commission on orders placed through their website. The incremental costs to the marketplace for an incremental order is website hosting, payment processing, and customer support. Since the delivery restaurant is the one handling the delivery, the operational complexity for a food delivery 1.0 marketplace is minimal.

Source: Company Filings, Optimist Fund Estimates

The unit economics are uniquely attractive.

The unit economics of a food delivery business is contribution profit per order multiplied by the number of orders placed over the lifetime of a customer compared against the cost to acquire a customer.

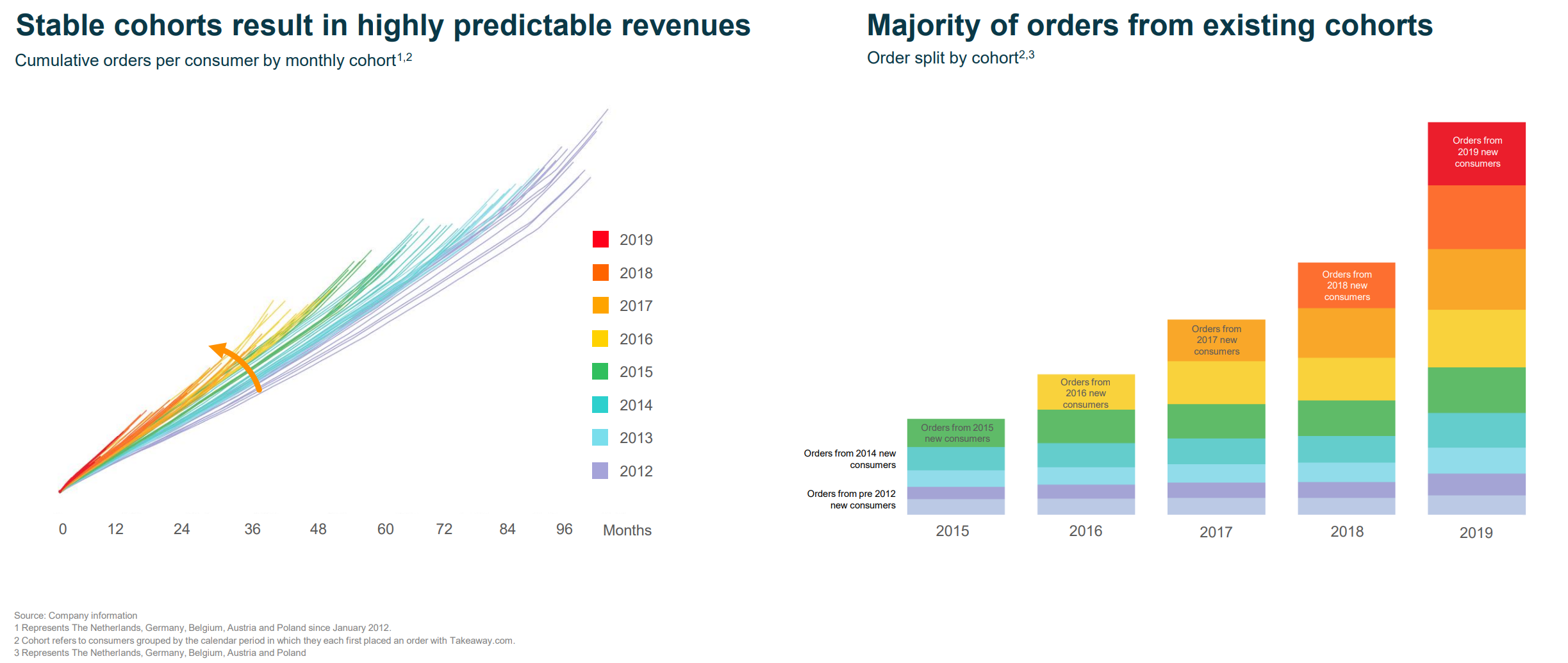

Food delivery 1.0 marketplaces have attractive customer economics due to the high levels of customer retention and repeat usage. Once a customer uses a food delivery platform, they typically use it more and more as time goes on. The consistent annual growth of customer cohorts profit contribution is unique for e-commerce companies where typically new customers spend 50% less in year 2 as they did in year 1.

Source: Takeaway.com FY2019 Analyst Presentation

Grubhub, Delivery Hero, and Just Eat Takeaway, in general, had a 1-year payback on customer acquisition spend. For every dollar spent on advertising, food delivery 1.0 marketplaces would earn $1 dollar in contribution profit in the first year. After the first year, consumer cohorts would continue to generate at least $1 dollar of contribution profit annually. Today the companies have cohorts that are over 10 years old that continue to grow. In other words, $1 invested to acquire customers has returned over $10 dollars in contribution profit over the life of their oldest cohorts. These are highly attractive customer economics.

The strong unit economics of food delivery 1.0 marketplaces eventually drove robust consolidated financial results evidenced by Just Eat Takeaway’s Netherlands business which used to generate over 50% EBITDA margins and 8% margins as a percentage of gross merchandise volume.

Just Eat Takeaway’s Netherlands business was the blueprint of a successful food delivery 1.0 marketplace.

Source: Takeaway.com 2018 Analyst Presentation

To the original question “Will leading food delivery businesses be valuable free cash flow generative companies?”, for Food Delivery 1.0 marketplaces the answer is a resounding yes. Just Eat Takeaway’s UK, Netherlands and German businesses, Grubhub’s US business, and many other markets have generated EBITDA margins of 5-8% of GMV which translates into 4-6% free cash flow margins.

A shift in the food delivery market was beginning to emerge.

In the 2011-2015 time period food delivery companies like DoorDash, Postmates and Deliveroo (based in the UK) were founded to provide delivery for restaurants that did not deliver. As these companies grew in popularity, questions began to emerge as to what impact this would have on food delivery 1.0 marketplaces.

“They aren’t competing with us” several food delivery 1.0 marketplace executives would say. They weren’t lying. For example, Deliveroo in London was focused on providing delivery for higher end dine-in restaurants that would never be viewed as competition to the cheap delivery restaurants you would find on Just Eat’s marketplace. The restaurant selection was fundamentally different.

But if a consumer in Manhattan, who orders Chinese food from a food delivery 1.0 marketplace every Friday decides to switch it up and order from Appleby’s on Uber Eats, all of a sudden that creates a new competitive alternative.

The competitive dynamics of the industry were beginning to change and the establishment of the food delivery 2.0 era emerged.

This was part one of our three part series “The Global Food Fight”. Subscribe to our updates and letters below to be notified when part two, Food Delivery 2.0 is released.