It’s Uber’s Time to Shine

Over the last 10 years Uber has garnered significant criticism around their aggressive growth at all costs mentality.

“Will they ever make money?” skeptics would say.

Well, the time has come.

Uber is at a fundamental inflection point.

In 2022 Uber plans to be free cash flow positive and in 2024 they expect to generate almost $5 billion of free cash flow.

Today, cities would not be the same without Uber. They have a fantastic product, significant growth opportunity, and durable competitive advantages that we believe will enable the business to become a multi hundred billion dollar market cap company.

Source: Uber Financial Statements and Optimist Fund Estimates

Uber changed the transportation landscape for the better.

Uber is known for inventing the ridesharing category by ordering a driver through your mobile device. Today they are the global leader.

Source: Uber 2022 Investor Day Presentation

People often forget how brutal cabs were before Uber. Not only was it challenging to reliably get a cab in a convenient manner but payment was terribly inconvenient. Many cab drivers would refuse to take debit or credit and do the old “our machine is broken” tactic. Even when the machine did work, it usually took an additional 2-3 minutes to pay, delaying the driver from picking up another rider and the passenger from getting to where they need to be. Uber made the process of requesting a ride one of the most seamless consumer transactions. There is no question that Uber has changed the transportation landscape in a positive way.

Uber has significant growth opportunity ahead.

The vision for the company is to be able to use Uber for any transportation need. Today Uber is less than 1% of consumers weekly trips in the United States through Uber Black, UberX and UberX Share. We believe these core products underpin mid-teens revenue growth for the next 5 years but on top of this, Uber continues to expand the use cases of their app through incorporating public transportation, high capacity vehicles, and even flights and long haul trains which is currently being tested.

Source: Uber 2022 Investor Day Presentation

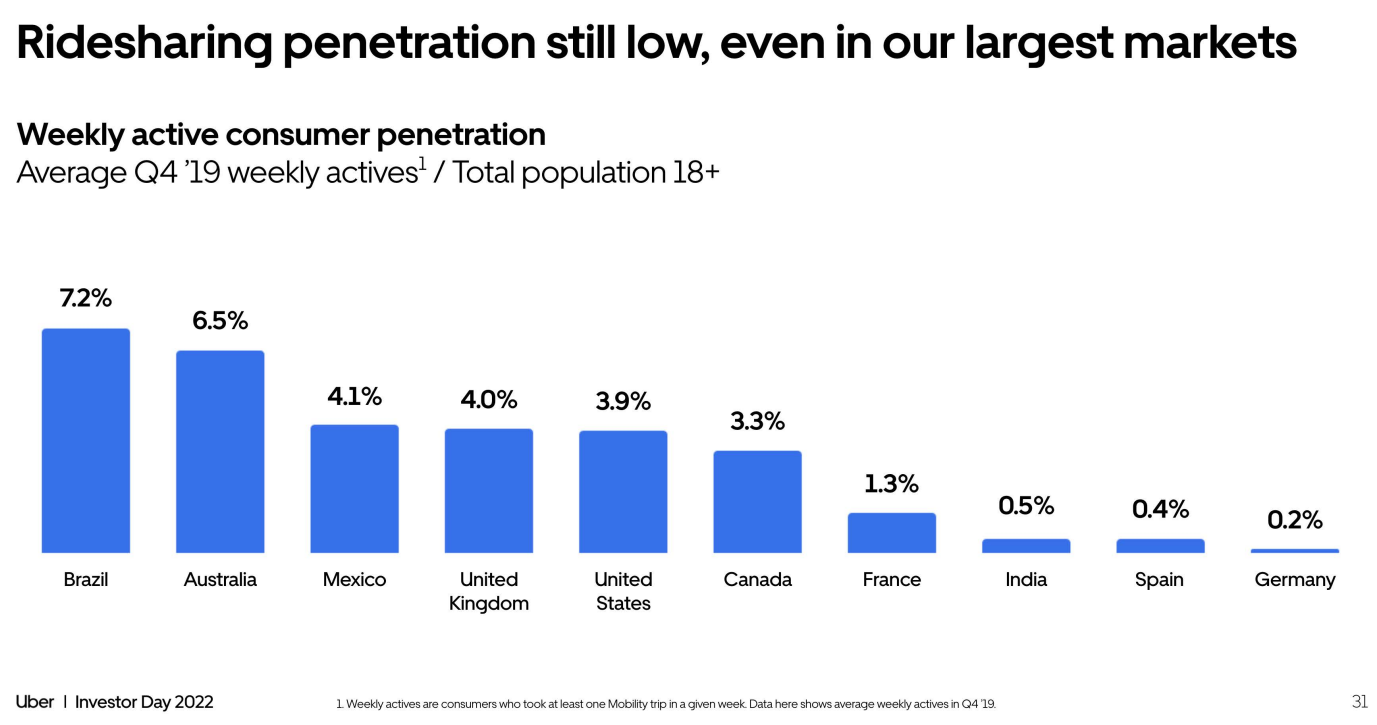

Though it is exciting to think about future opportunities from adjacent products, the main growth driver will be the natural expansion of the core rideshare penetration rate. Even in their most penetrated markets like Brazil, they continue to expand. As you would guess, the penetration rates are much higher in populated cities and among younger demographics. Deepening their presence in the suburbs and benefitting from a higher percentage of adults being digital natives as the population ages should provide tailwinds. We believe that over time the penetration rate could surpass 10% in all of their markets.

Source: Uber 2022 Investor Day Presentation

Uber’s network is exceptionally difficult to replicate.

Ridesharing businesses are difficult to build because they are on-demand and regional.

On-demand marketplaces are uniquely challenging.

Typically when consumers use Uber they want to go somewhere immediately. This means Uber needs drivers queued up ready to go at a moments notice.

Over 90% of Uber rides are requested for real time pick up and the average wait time between requesting a ride and being picked up is ~5 minutes. Uber needs enough drivers to keep wait times low ensuring a good consumers experience, but not so low that they end up with a surplus of drivers sitting around waiting to be dispatched. Balancing the supply and demand of the network is done through consumer incentives, and driver incentives. Scaling up both sides of the network in unison is difficult and expensive which is why it is a one or two player market in every country.

Supply and demand is regional creating narrower network effects.

Where non-perishable good marketplaces like Etsy could have sellers in Florida that offer products to Torontonians, Uber can’t get a driver in Austin, Texas to pick you up from a Lakers game in Los Angeles. A lot of marketplaces can internationalize because if the product can be shipped by FedEx then in theory it can be sold anywhere in the world. This allows those businesses to market internationally and build brand awareness while leveraging their domestic seller base. An Uber ride on the other hand cannot be shipped. If they have a million drivers in the U.S. they still can’t offer someone a ride in Paris, France. Uber needed to win supply and demand in every single region they entered which makes scaling this business across the world significantly more challenging than most other marketplace businesses.

Ridesharing is a regional business that benefits from global scale.

Uber expanded internationally very early in the maturation of the company first entering Europe in late 2011 when the company was under 3 years old. Their aggressive international expansion was possible because they were able to raise $15 billion in the first 7 years of the companies existence. They knew the ridesharing industry was a global land grab, so they grabbed as much as they possibly could. In area’s where they didn’t think they could win they merged with the leading player and retained an equity stake in that entity. Today Uber holds significant equity takes in DiDi (the leading Chinese Rideshare Platform), Grab (the leading southeast Asian rideshare platform) and Yandex (the leading Russian rideshare platform).

Even though Ubers’ driver supply in Texas doesn’t help them in New York, there are benefits to being a global platform:

Cross border travel: When consumers fly internationally they can get picked up with an Uber in almost every developed country and all of Latin America. If you travel, there is a good chance you will use Uber.

Global scale allows Uber to spend significantly more money on product than smaller regional players.

One unified global brand is a customer acquisition advantage. For example, if you are advertising around a global event, it helps to show a brand that a consumer can actually purchase in their own country. If Uber sponsored the World Cup, a very large portion of the people watching the World Cup have Uber in their country. Lyft on the other hand could never get the same benefit from that advertising campaign since they only offer a service in North America.

By far the most valuable element of being a global platform is their financial scale. Uber generated over $10B in gross profit over the last 12 months. This gives them significant scale to attack competitors, enter new markets, improve their products and potentially return capital to shareholders.

Ride hailing players have shifted their focus from incremental market share to incremental profit margins.

Historically the ridesharing market had been described as irrational because Uber and Lyft were growing aggressively while losing money. Remnants of this narrative still exist today that we believe has provided a remarkable investment opportunity in Uber.

Today the ride sharing market is established. North America is a two player market consisting of Uber and Lyft. Uber has ~70% market share, while Lyft has ~30% which has been stable for over 2 years.

Source: https://secondmeasure.com/datapoints/rideshare-industry-overview/

Today both companies are focusing on incremental margins more than incremental market share suggesting the ride sharing industry will begin to generate significant profits. In fact, Uber laid out a goal to generate $5 billion in EBITDA in 2024 at their most recent investor day. Several months later, Lyft followed suit, expressing their intention of generating $1 Billion of EBITDA and $700 of free cash flow in 2024. Both market participants have been clear, scaling profits is their focus. As they scale profits we believe investors will come to realize they are in fact an economically attractive business model that was early in its maturation.

The same dynamic exists in most of their international markets as investors across the globe have shifted from growth focused to profit focused. This global trend is positive for scale players such as Uber who already have the scale to be an economic business.

We believe that a few years from now the rideshare industry will be viewed similar to payment networks, railroads, or credit rating agencies, which are all concentrated, highly profitable, beloved industries.

In 5 years we believe Uber will be worth 7x today’s value.

From now until 2028, we believe Uber can grow revenue 15%-20% annually and achieve free cash flow margins of 20% translating to ~$7 of free cash flow per share. Applying a 25x free cash flow multiple and adding back cash and equity stakes equates to a target price of $200 or a 48% internal rate of return from their current share price.

We think it’s a compelling investment opportunity.

Disclosure: Uber is a holding in Optimist Fund.