The Global Food Fight: How Valuable Can Food Delivery Leaders Become? (Part 3/3)

The growth opportunity is enormous.

Online food and grocery delivery remains under 15% penetrated across all developed markets. As much as the industry has exploded over the last 5 years, we believe we remain in the early innings.

GMV = Gross Merchandise Volume

US food delivery and online grocery penetration is around 10% today. Over the next 10 years, we believe food delivery platforms can penetrate 30% of industry spend and online grocery can reach 35% penetration underpinning mid-teens revenue growth in both categories.

Online on-demand commerce in non-food categories is under 1% penetrated.

Total US sales of general merchandise categories such as clothing, home furnishings, electronics, sporting goods, and office supplies totals ~$1.5 trillion annually. Today we believe that under $5B worth of goods in these categories would be delivered in under 2 hours. A mere 2% penetration rate would drive significant growth for on-demand commerce platforms given the size of the market. This market presents significant opportunity, but time will tell if under 2 hour delivery in categories beyond food and convenience store items really takes off.

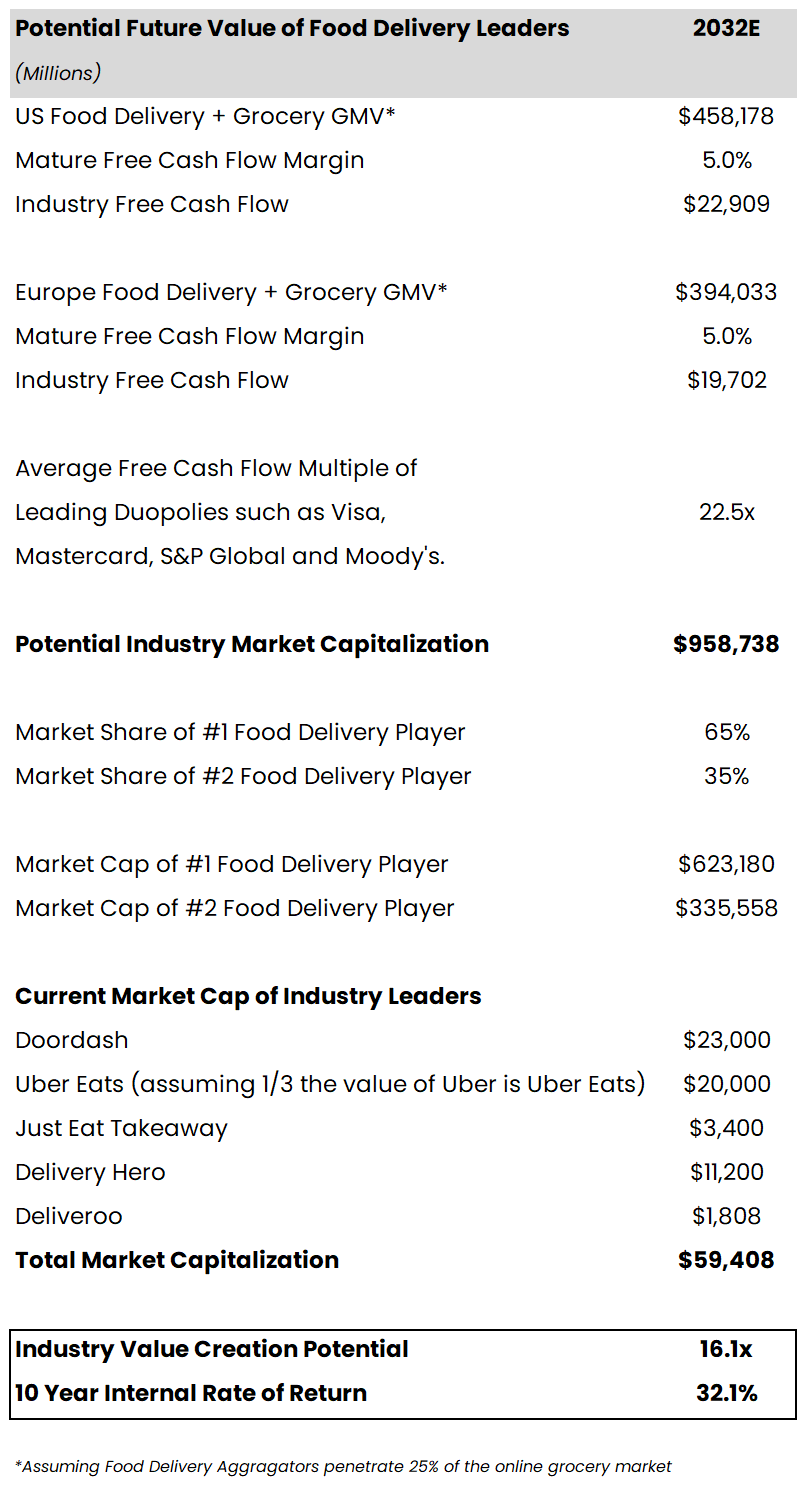

We believe the aggregate market capitalization of the food delivery industry in North America and Europe can approach $1 trillion in the next decade.

Source: Optimist Fund Estimate, Statista, Company Filings, fred.stlouisfed.org

As at: September 22, 2022

Based on only the core restaurant and grocery opportunity, we believe the food delivery aggregator industry will support close to a trillion dollars in market capitalization in 10 years. This does not include other retail verticals or other adjacent opportunities that will unfold over time.

By sizing the opportunity, it makes sense why companies in the space have invested so aggressively in attempts to win.

The size of the prize is definitely worth the fight.

Today Optimist Fund own’s Uber, Doordash and Just Eat Takeaway. We will discuss each of these holdings in more detail in future commentary.